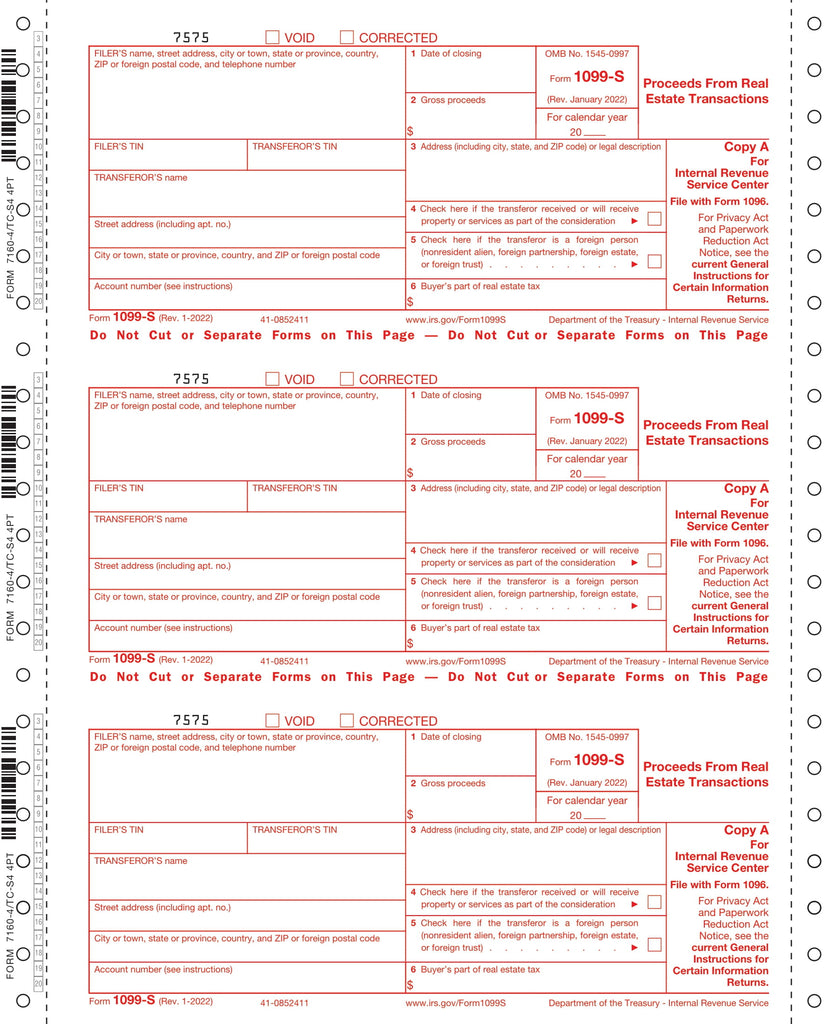

1099-S, 4-Part, 1-Wide, Continuous

$ 0.68

1099-S Tax Form Carbonless 4 Part

Tax Form TC-S4

Tax Form 71604

Minimum order 50.

To be used for the reporting the sale or exchange of one-to-four family real estate. Note: The Energy Policy Act of 1992 amended section 6045(e)(4) to require filers of Form 1099S to report any real estate transactions involving real estate.

1099-S Proceeds from Real Estate Transaction

Copy A, State, B, C

Continuous, Carbonless

For use with envelope DW19W or self seal envelope DW19WS.

Also known as Greatland tax form CS054