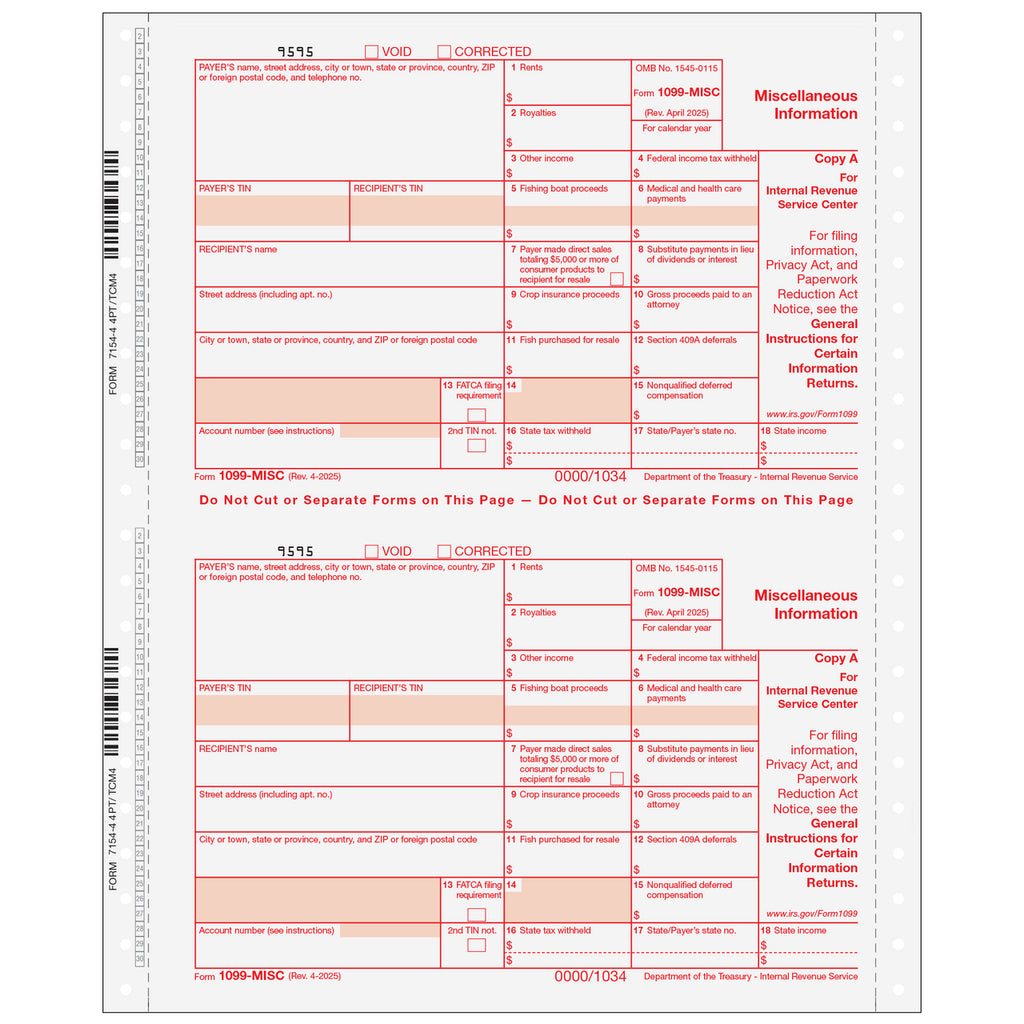

1099-MISC, 4-Part, 1-Wide, Continuous

$ 2.47

1099-MISC Tax Form Carbonless 4 Part

Tax Form TC-M4

Tax Form 71544

Tax Form CMIS054

Minimum order 50.

For use in reporting rents, royalties, prizes and rewards, fees, commissions to non-employees and health-care payments.

Note: 1099-MISC - NO longer used for Non-Employee Compensation. If you typically file any 1099-MISC forms (with Box 7 completed), you will need to file Form 1099-NEC for tax year 2020. Data currently reported in Box 7 (Nonemployee compensation) of Form 1099-MISC for tax year 2019, will be required to be reported in Box 1 of Form 1099-NEC for tax year 2020.

1099-MISC Miscellaneous Income.

Copy A, State, B, C

Continuous, Carbonless

One Sheet = 2 Forms. Order by number of forms needed.